On July 19, 2024, NITI Aayog released a comprehensive report titled “Electronics: Powering India’s Participation in Global Value Chains (GVCs).” The report provides an in-depth analysis of India’s electronics sector, its current position, challenges, and the strategic roadmap to transform India into a global manufacturing hub in the electronics industry.

Key Findings

- Global and Indian Electronics Market: The global electronics market is estimated at US$ 4.3 trillion, with India’s share being US$ 155 billion as of 2022. China leads as the world’s largest electronics producer, accounting for 60% of global production. India’s electronics exports are approximately US$ 25 billion annually, representing less than 1% of the global market. However, India aims to achieve US$ 500 billion in electronics production by 2030.

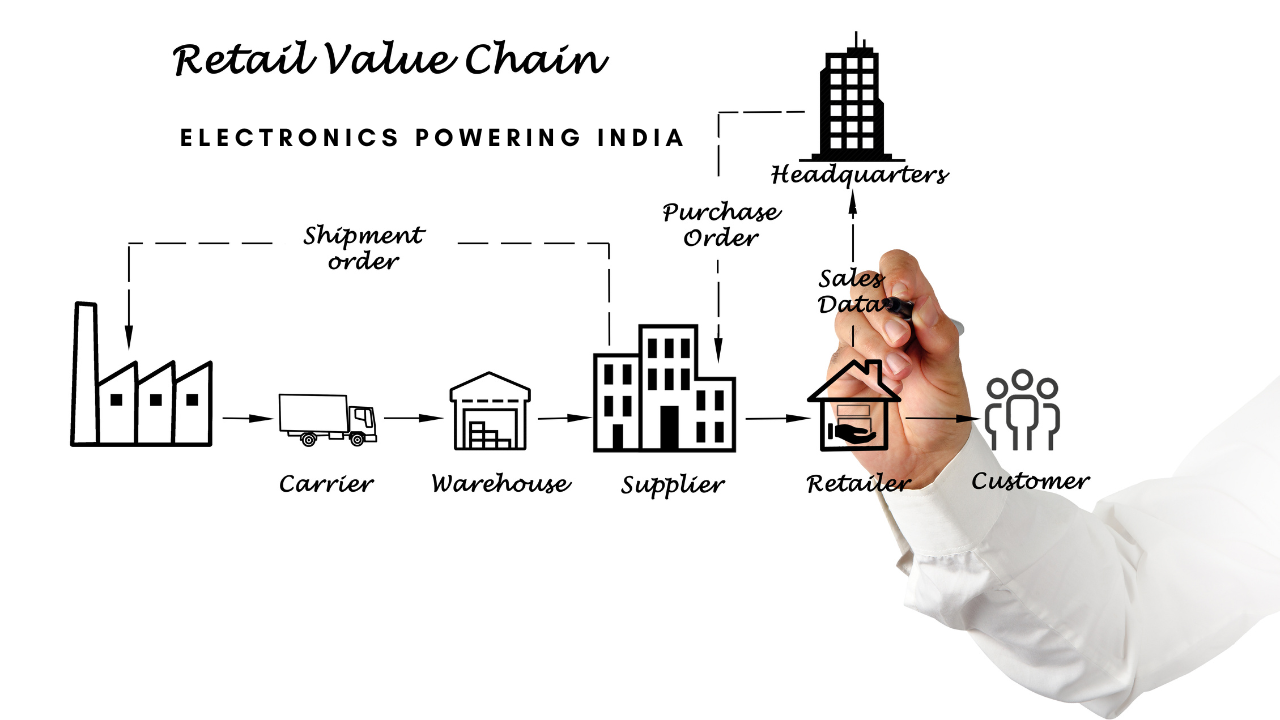

- Global Value Chain (GVC) Participation: Over 75% of India’s electronics exports are integrated into GVCs, emphasizing the sector’s global nature. The report highlights the critical need for India to enhance its GVC participation, especially in sectors like electronics, semiconductors, automobiles, chemicals, and pharmaceuticals.

Driving Factors

- Rising Global Demand: The increasing broadband penetration in developing countries is driving demand for electronic products.

- Supply Chain Diversification: There is a global trend to diversify supply chains beyond China due to concentration risks, as seen during the COVID-19 pandemic and ongoing trade tensions between China and the USA.

Challenges in India’s Electronics Production

- High Import Tariffs: India faces relatively high import tariffs compared to competitors like China and Vietnam, making its products less competitive in global markets.

- Lack of Electronics Component Ecosystem: India lacks a robust ecosystem for critical components like semiconductors, affecting the competitiveness of its electronics manufacturing sector.

- High Cost of Capital: The cost of capital in India ranges from 9% to 13%, significantly higher than in countries like China, Vietnam, and Taiwan, where interest rates are between 2% and 7% due to specific interest subsidies.

- Other Challenges: Inadequate infrastructure, lack of R&D and design ecosystem, and shortage of skilled engineers and workforce further hinder the growth of India’s electronics sector.

Recommendations

- Fiscal Interventions: The report recommends capital expenditure support for high-complexity components, innovation schemes to promote R&D, and localized regulations, such as labor laws, to support the electronics sector.

- Non-Fiscal Interventions: Simplification of tariffs and rationalization of taxes, support for industries in skilling, setting up electronics skills training hubs, and simplifying the process of technology transfer to improve the ease of doing business.

Steps Taken by India to Promote the Electronics Sector

India has already initiated several schemes to promote electronics manufacturing, including:

- Electronics Manufacturing Cluster (EMC) 2.0 Scheme (2020)

- Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS)

- Design Linked Incentive Scheme

- India Semiconductor Mission

India’s Global Electronics Landscape

The report underscores that in the financial year 2023, India’s electronics sector recorded a significant value of exports, contributing 5.32% to the country’s total merchandise exports. This highlights India’s growing competitiveness in the global market and its ability to capitalize on international demand.

The Path Forward

India’s electronics manufacturing is currently focused on the final assembly of goods. However, there is a growing trend of outsourcing assembly, testing, and packaging tasks to Electronic Manufacturing Services (EMS) companies in India. Despite this progress, the ecosystem for design and component manufacturing remains in its early stages.

As India strives to become a developed nation, the manufacturing sector, particularly electronics, will play a pivotal role. By engaging more deeply in Global Value Chains, India can accelerate its journey towards becoming a global manufacturing powerhouse. The report by NITI Aayog outlines a strategic roadmap to achieve this vision, positioning India as a key player in the global electronics landscape.